Paycheck tax calculator georgia

Georgia Georgia Hourly Paycheck Calculator Results Below are your Georgia salary paycheck results. Paycheck Results is your gross pay and.

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

All you have to do.

. The first thing you need to know about the Georgia paycheck calculator is your hourly and salary income as well as the various pay frequencies. Use the Georgia paycheck calculators to. Paycheck Results is your gross pay and specific.

If you want to determine your. Get an accurate picture of the employees gross pay. If youre not yet registered.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. With just a few clicks the Gusto Georgia Hourly Paycheck Calculator shows you how payroll taxes are calculated.

If you make 100000 a year living in the region of Georgia USA you will be taxed 20339. Ad Payroll So Easy You Can Set It Up Run It Yourself. Calculate your federal Georgia income taxes Updated for 2022 tax year on Aug 31 2022.

Payroll processing doesnt have to be taxing. Pay electronically directly with DOR. Georgia Bonus Tax Aggregate Calculator Results Below are your Georgia salary paycheck results.

Use the Georgia dual scenario hourly paycheck calculator to compare two hourly paycheck scenarios and see the difference in taxes and net pay. The results are broken up into three sections. This Georgia bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

The Weekly Wage Calculator is updated with the latest income tax rates in Georgia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Weekly. In a few easy steps you can create your own paystubs and have them sent to your email. Ad Create professional looking paystubs.

2022 tax rates for federal state and local. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Georgia Income Tax Calculator 2021. The Georgia Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. The results are broken up into three sections.

The Federal or IRS Taxes Are Listed. County Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. Paycheck Results is your gross pay and specific.

Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use the Georgia Tax Center GTC the DORs secure electronic self-service portal to manage and pay your estimated tax. If you make 70000 a year living in the region of Georgia USA you will be taxed 11993.

These calculators should not be relied. The results are broken up into three sections. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

The PaycheckCity salary calculator will do the calculating for you. Your average tax rate is 1501 and your marginal tax rate is. All Services Backed by Tax Guarantee.

We use the most recent and accurate information. Your average tax rate is 1198 and your marginal tax rate is. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull.

Georgia Salary Paycheck Calculator Results Below are your Georgia salary paycheck results. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Georgia Income Tax Calculator 2021.

Georgia payroll calculators Latest insights The Peach State has a progressive income tax system with income tax rates similar to the national average. Tax Calculators Tools Tax Calculators Tools.

Income Tax Calculator Estimate Your Refund In Seconds For Free

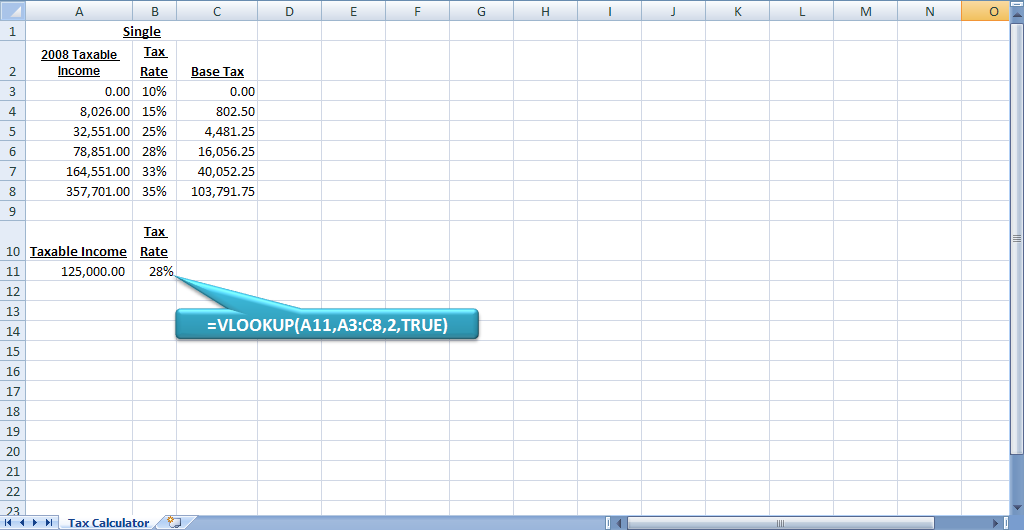

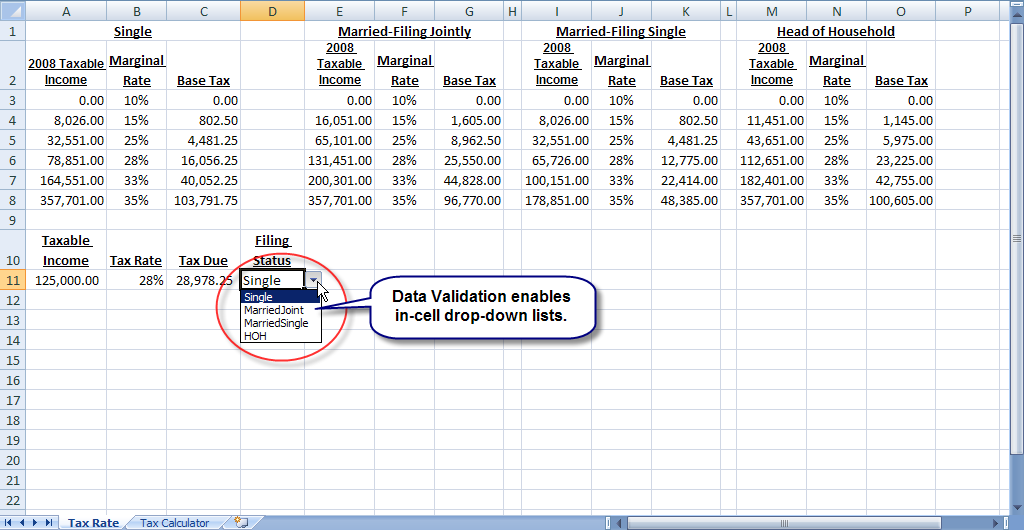

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Paycheck Calculator Take Home Pay Calculator

Georgia Tax Calculator

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Payroll Taxes Methods Examples More

![]()

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

How To Calculate Payroll Taxes For Your Small Business

Paycheck Calculator Take Home Pay Calculator

Georgia Sales Reverse Sales Tax Calculator Dremploye

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Georgia Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Use Smartasset S Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs Retirement Calculator Financial Advisors Tax